Americans aren’t the only ones struggling with changes to their health plans lately. International students at St. Thomas are affiliated with a different insurance company this year and the new emergency health plan is generating some buzz.

Maite Loria, a fourth-year international student who attended the health insurance information session last week, bemoaned the new insurance plan. She thinks a mandatory emergency health plan is not the best option.

“We live in Canada and we deserve to be covered fully; we are not vacationing,” Loria said. “An emergency health plan is for emergency situations for people who are travelling in countries that are not their own.”

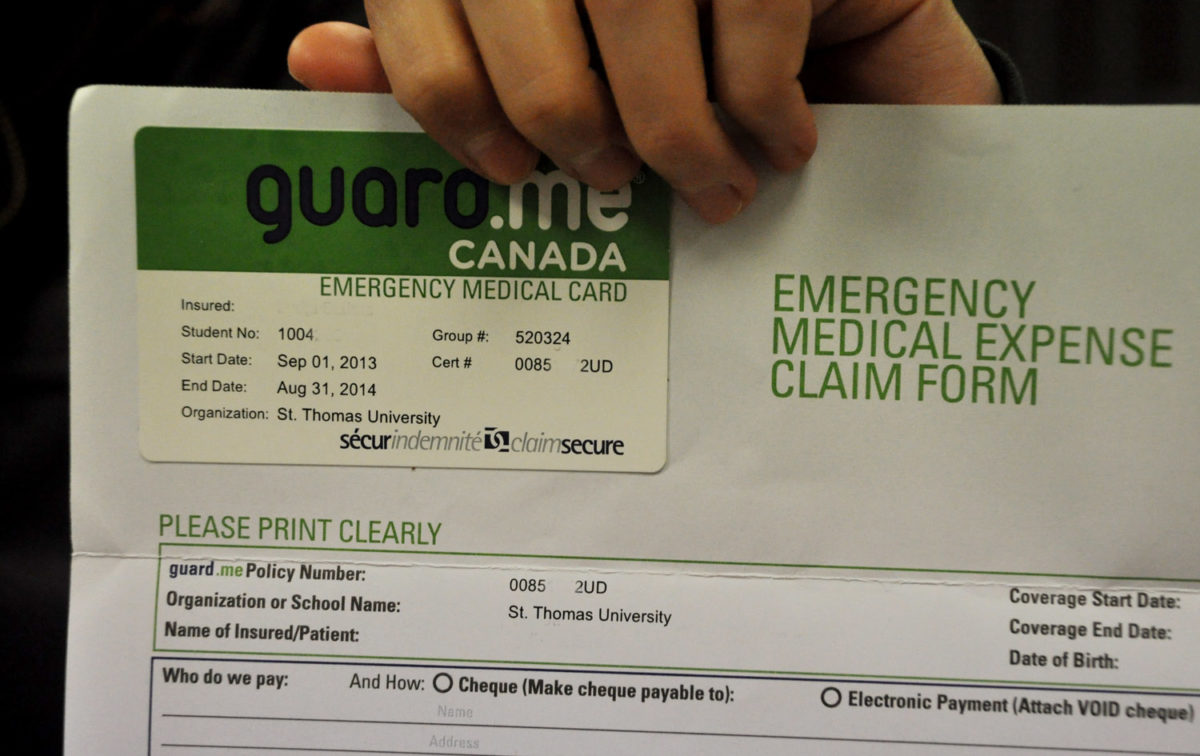

International students pay $284 for the new Guard Me Emergency Insurance Plan. The plan is not optional because it is a policy at STU that all international students have to be covered by the same emergency plan to avoid logistics problems.

Reg Gallant, financial services comptroller at STU, said during previous years the university was covering the premium health plan as part of the international tuition, with no additional fees. Not enough international students were using the premium plan to its full benefits, so they added a fee for the health insurance to help.

“Last year our students were utilizing the plan at 65 per cent of what the premium paid, which is very low, usually it is at least 80 per cent,” said Gallant.

Gallant said there are two significant differences between the former and the new plan. The current insurance doesn’t cover pre-existing conditions and students have fewer options when choosing a doctor.

“For us it seems to make a lot of sense; if our students weren’t using those types of benefits, why were we paying for them?” Gallant asked.

The most concerning issue for international students is related with pre-existing conditions, as Guard Me will only cover one physical examination a year up to $150, including any tests or lab work.

“If there’s been a diagnosed condition that you’re bringing with you to the country, you’ll have a problem,” Gallant said. “But if the condition worsens in Canada, they’ll cover until the condition gets back under control.”

Gallant said STU’s main concern this year was to keep the cost as low as they could. However, they do plan to observe how the new insurance plan develops along the year.

“Certainty, if there are any issues that cramp up through the year [international students] should be letting us know because when this policy comes up for renewal next year any information we have will help us to make a more informed decision,” said Gallant.