I dream of retirement filled with my Jags winning the super bowl, with a Cuban cigar in one hand and scotch in the other. Although saving now might not make all my dreams come true, certainly it helps to plan now. Some might think 24 years old is a little too early for it, but it’s prime time to plan for the future.

Many experts say planning now is essential in avoiding later pitfalls like having to come out of retirement. They suggest by asking yourself what you want to do in retirement and planning around it. Of course things will change and your budget will also, but thinking of these things now can only help.

Someone beginning retirement saving in their 20s would have to set aside 20 per cent of their earnings. Seems like a lot but starting their 30s that number jumps to 30 per cent and in their 40s that figure would stand at 40 per cent of overall earnings. With those kind of figures it would seem impossible to have a proper budget if 30 per cent of your entire budget is strictly dedicated

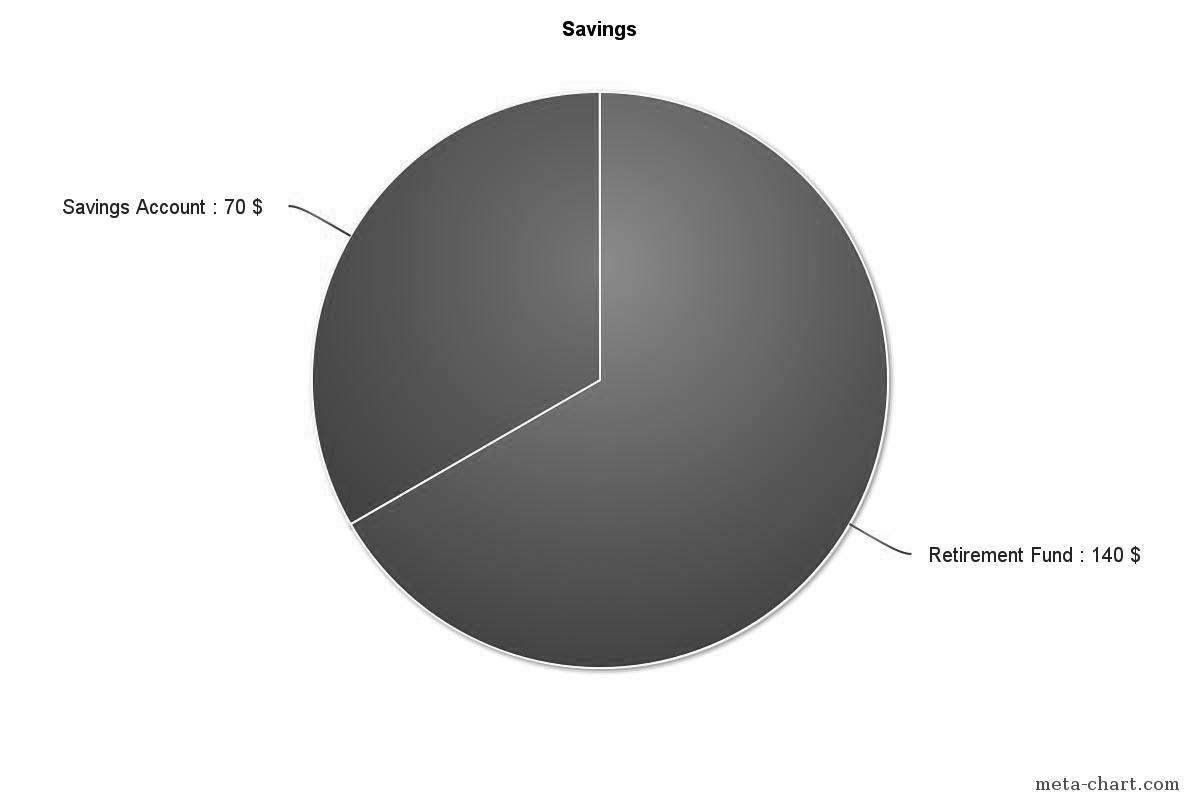

Starting now, with my $700 a month I would have to set aside $140 for retirement. In a year that number would grow to $1,680. If you’re a low income earner like me then a Tax Free- Savings Account, TFSA, would make the most sense. But as we enter career fields and hopefully more earnings a Registered Retirement Savings Plan, RRSP, would make the most sense. Also some work places offer rrsp matching so keep that in mind when job searching.

Given the state of social security and the Canadian Pension Plan, it is penitent to save money on your own. It’s like planning for the worst but hoping for the best. Jobs offer RRSP matching and sometimes up to 5 per cent of savings.

That match could exponentially grow. Lets say you have a $30,000 salary with a company willing to match 5 per cent of retirement savings. That would amount to $1,500 and over a 20-year career that would rocket up to $30,000 by them and $30,000 by you.

Say you set the other 15 per cent of earnings into another savings account over a 20-year career that would bring you to $90,000 invested by you at the end of your career and a grand total of $150,000. These figures do not include interest on accounts or even raises, which come with most jobs.

It may seem hard to set aside that kind of money but budgeting seems to be key to having the retirement you want. Some banks offer finical advisors that may help to better offer financial planning and clear up questions about the different retirement options. Your parents could also help with advice. What is clear the sooner you start the better you’ll be in the future.

I know cost of living as student is high. Tution, text books, rent and everything in between can seem daunting and the last thing we think of is our plans 40 years from now. But a clear plan now can mean the difference between living blissfully in your golden years or coming out of retirement to cover unexpected costs.

Student debt is massive and tackling that is probably on the fore front of most students. But our current finical struggles should not continue to dictate our lives and control how we view our retirement goals.