Jesse LaPointe is a third-year English major, concentrating in drama. He lives in an apartment downtown with his single mother. He works all summer, every summer, and almost 30 hours a week during the school year in an effort to pay for his education. This year, he decided to apply for a student loan to supplement his income so he could cover his tuition.

The loan only came to $2000. LaPointe’s student loan assessment said his mother would have to pay around $4000 towards his education.

“She works like a dog, yet still I can’t see any possible reality where she can fork up $4000,” LaPointe said.

He was forced to drop out of St. Thomas.

LaPointe is going to take a year off to work and try for a loan for again next year but, at this point, there’s a lot of uncertainty.

“It’s no guarantee I’ll get it next year either, [but] I’ll try my luck.”

Parental contribution is a part of the New Brunswick student loan process. Student’s parents are “required” to pay for a certain portion of their child’s education. The Alward government reinstated the contribution when they moved into office in 2010, after the Liberals had taken it out in 2007.

Brian Gallant, leader of the New Brunswick Liberal party, pledged earlier this month to remove the parental contribution once again if the Liberals are elected in next September’s provincial election. He said it’s an “archaic” way to decide where loan money should go and counterproductive to the betterment of the province.

“It’s our priority to really re-kickstart our economy and ensure a good strong social fabric in our province,” said Gallant.

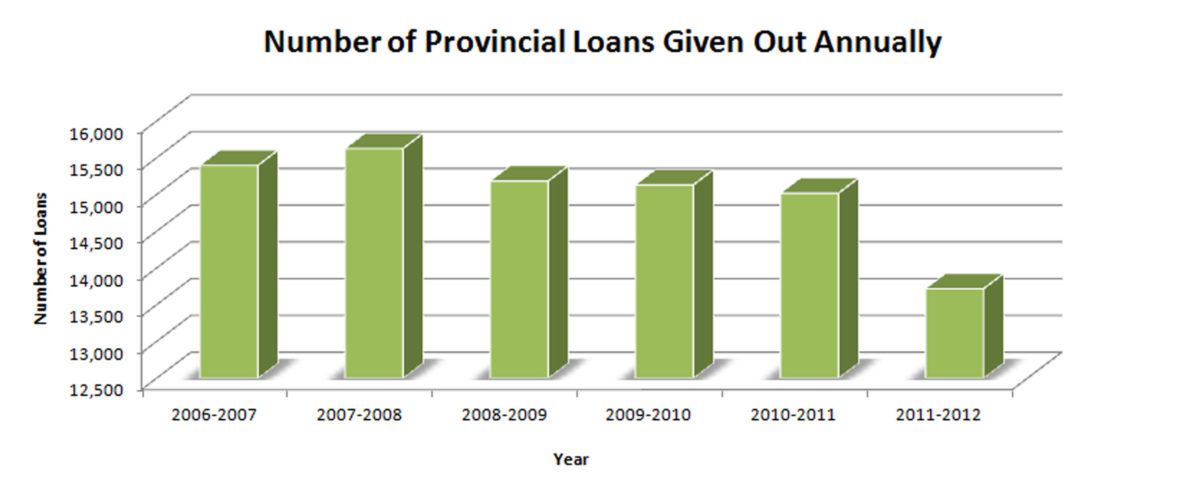

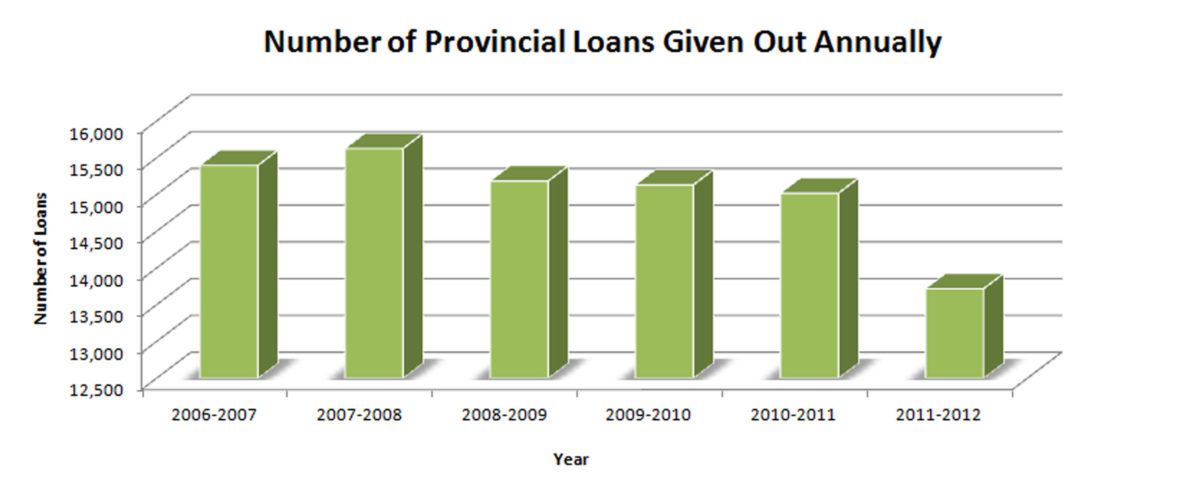

Last year, the number of student loans given out by the province dropped by 1,300. Student enrolled in universities across the province have also dropped by four per cent this year, according to a report done by the Association of Atlantic Universities.

Gallant said while he acknowledges there’s no one factor for those lower numbers, he certainly thinks the parental contribution inhibits students, which in turn inhibits enrollment.

“Do I think that the parental contribution that was inserted back into the equation has played a role in fewer access to student loans and grants and fewer university students? Absolutely.”

Dominic Cardy, the provincial leader of the NDP, agrees the parental contribution does more harm than good. However, he doesn’t think its removal would fix the near-overwhelming problems with the student loan system. Cardy said student loans need complete overhaul.

“I’m fairly convinced the system makes no sense.”

Cardy said the system isn’t intuitive to the real lives of the students and their parents. Not all parents agree that their children should be going to university, and some students aren’t on good terms with their parents.

This contribution assumes a parent-child relationship that isn’t always true to life.

“The difficulty with tuition is that the parents aren’t going to universities. It’s the students, obviously, and if you’re trying to force parents to pay, you’re also getting into all sorts of difficult family situations.”

Ideally, Cardy would remove tuition altogether. If tuition was entirely government-funded, this would give post-secondary institutions the freedom for higher admission standards. There would be no need for loans. People who really want to go to university would have to work hard in school and this would produce more skilled workers.

“That’s supposed to be the point of university. [It’s] not just a continuation of high school. It’s a place you go to get specific skills and to open your mind in the ways that university can give you.”

Gallant also thinks post-secondary education could benefit from both an ease in access and elevated standards.

“It’s always been a huge issue that I’ve been advocating for. I’ve always wanted to have more accessible, higher quality post-secondary education.”

No one from the premier’s office or from the department of post-secondary education was available for comment.

LaPointe felt the loan system alienated people from lower-income backgrounds. He said most people who go to university come from families with money and are capable of avoiding too much debt. But, for the rest of the student population, options are limited.

“I wish that student loan options branched out to people from all walks of life so that everybody can get a shot at it, if they feel so obliged.”

Student loans have nothing to do with academic ability. Cardy said post-secondary education and loans have directed their focus from learning into money. He said the particular processes of student loans – giving out money then getting it back – are run through the banks and they’re the ones who reap the rewards.

“The banks are making profit off this system while it’s clearly restricting access to New Brunswick kids.”

Cardy said the system is bureaucratic to the point of bizarreness.

Getting money is one thing, but being able to understand how to get it is something else entirely. For a service supposedly devoted to helping students, the red tape and legalese are demonstrative of the exact opposite.

“That’s the problem with the student loan system. It’s so complicated,” said Cardy. “You need to have a degree to be able to understand what’s going on with how you’re supposed to get the loans and pay them back. It’s a pretty nightmare system.”

Thankfully, gnb.ca has a “Calculating a Parental Contribution” section to help. They provide a sample student, “John.” John comes from a four-person household with a gross income of $75,910. After several calculations, it’s decided John’s parents should contribute $685 to his education.

While this may seem reasonable, LaPointe’s mother was asked for $4000 up front in order for her son to continue classes.

LaPoint said he’s now disillusioned and disheartened by the academic world which he still longs to be a part of. His whole future is up in the air because of money.

He sees this financial setback as a failure on his part and his inability to stay at STU as a loss of identity.

“I sat in the student lounge today and I felt like such an outsider…like this bum on his iPhone while everybody else was reading textbooks.”

LaPointe’s frustration is echoed by many students in different capacities.

They need financial help to stay in school and feel student loans are an unreliable source.

“I feel stunted by the loan system and not helped in any way and I’m not going to pretend I know how to fix the system…but all I know is that when I reached out for something to help me further my education…it didn’t help me at all.”